Premier Infra Services Offering Comprehensive Turnkey Solutions

How has the company progressed over the years?

Premier Infra Group is a consortium of multifaceted Turnkey Engineering Companies. Our various services include Lifting and Launching, Transportation, Civil Works, Geotechnical works, In-house Designing and Fabrication. We are constantly expanding our in-house fleet by adding top-of-the-class and most sophisticated machines in the industry, and providing comprehensive turnkey solutions across India, Sri Lanka and Nepal. Our fleet now comprises of more than 50 Hydraulic and Crawler Cranes (35-500 tons), 20 Tower Cranes (5- 25 tons), 110 Axle lines, 50 Trailers, 8 Piling Rigs, and associated machinery.

We have executed more than 70 lakh MT of Lifting and Launching assignments over the past 15 years, and we handle Transportation and Launching jobs of more than 10,000 ton-km on a daily basis. We have seen a y-o-y growth of about 80% in the last 3 years, despite the challenging Covid times, and have closed the last financial year (2021-22) with a revenue of almost INR 210 cr (approx 27 million USD).

In a space where most infrastructure companies are in a race to become Asset Light to impress their investors, we are eyeing at becoming more asset heavy by adding top-of-the-line equipment and machinery to our fleet.

What transformation are you experien-cing in the heavy lifting industry of India in recent years?

With the kind of Infrastructure growth seen in India in the past 5 years, the heavy lifting industry has had a very positive impact and is growing at a scale never seen before. The biggest transformation I believe is that now Civil Infrastructure projects are conceived and executed after understanding the features, capacities, applications, and capabilities of Lifting Equipment. Earlier, Lifting Machines required in a project were called at a later stage and changes were made in the design and execution strategy, which lead to huge delays in project completion. Today, we are seeing thorough planning for seamless execution and timely completion of Infra projects.

The lifting industry is now being recognized on national platforms. With organizations like CERA and Indian Crane Owners Association educating and safeguarding the interests of the members, new players are entering the market and bringing value addition to the Industry.

Though the logistics and lifting industry is booming, it faces issues like demand-supply gap, hike in operational costs, high fuel prices, and inflation. How does your company manage to sustain amidst these issues?

Yes, a hike in overall operational costs, fuel prices and inflation, including the increase in Crane prices linked to appreciation of steel has affected our gross margins and revenue numbers. It must be noted that because of competition, the Rental Rates for most equipment have come down over the past ten years. A small 70-ton Crawler Crane, which ten years back would’ve fetched 5-6 lakhs per month, would now get only 3-4 lakhs for the same assignment. It is the same case with most heavy capacity Hydraulic and Crawler Cranes.

With a lot of new and in-experienced players entering the market, it’s quite a common practice for them to take projects at very nominal rates to sustain their financial liabilities, but it is not long before they start compromising on their performance. This is where our expertise comes in; we do not emphasize on being a Rental Company; rather, we focus on providing full Turnkey Solutions to clients. With an in-house fleet of cranes, supporting trailers, civil manpower, and a dedicated design team, we take up the job of delivering a full project.

Should there be standardization in the rates of lifting jobs?

This is something which has often been brought up and discussed as to why standardization of rates, especially in the lifting industry, is not possible.

I believe that we need to understand that any kind of lifting is a very specialized job and cannot be compared with other Infrastructure Service Industry jobs such as transportation or designing, or material providing.

For the exact same lifting job, someone can use an equipment from the 1980’s, while another company could use a brand-new crane. Different clients will have different payment terms and different crane owners would’ve bought a similar capacity crane for a very different price.

What we do need to talk about is the delay in payments by most infrastructure companies to the Crane and Transportation Service Providers. In an entire civil infrastructure project such as building of roads, housing, bridges etc, the crane providers and the transportation companies are the only two service providers that provide the required services and then remain at the mercy of the clients for their payments to be released. On the other hand, the providers of materials like steel, cement, aggregates etc, and services providers like geo-technical designers receive full advance payments before they release their material or render their services.

A crane supplier is kept hanging even after the project has been completed and sometimes several false debit notes are added. Such an attitude by the clients hamper the growth of this industry and dampens the entrepreneurial spirit of the businessmen engaged in this industry. I believe that if a Tri Party Agreement between the Bank, Client, and the Crane Service Provider is formed at the start of a project work (as done in most developed countries), then the problem of delayed payments can be mitigated.

What measures do you take to ensure that the operators of your machines are well trained and that your equipment is well-maintained?

When dealing with intricate and heavy machines like the cranes, the two most important factors for their accident-free running are skilled operators and timely maintenance. We organize an in-house 3- week operator training program, followed by a series of tests on the ground. All our machinery is digitally monitored and key data regarding their working hours, idle times, breakdowns, transportation routes, their lifting schedules, etc are monitored for seamless functioning.

With Chinese OEMs entering the Indian market, how do you see the market becoming more competitive vis a vis the German and American companies?

The next few years are going to be very interesting in the crane market. I believe that we might be witnessing this decade's biggest paradigm shift in the market share of crane OEMs. For the past several decades, we were seeing the market dominated by German and American crane brands like Demag, Liebherr, Grove, and Manitowoc. But now there are a lot of Chinese companies like Sany, XCMG, and Zoomlion in the crane space.

The difference in dealing with the European/ American and Chinese manufacturers for new cranes or parts, is that the Germans behave as if they are selling you a rare 20 carat diamond and will make you wait for weeks for delivery. But buying a crane from China is like buying a mobile phone; they will give you many options and very prompt service.

But having said this, Premier Infra Services does not have a single Chinese machine in its fleet yet, because we are used to the solid and robust working of our German cranes. Another reason why we haven’t invested in a Chinese crane is because the Chinese companies have yet to prove their products’ performance and efficiency.

In my opinion, the new, heavy capacity Chinese cranes are almost defying the laws of physics! To compare a 500-ton Hydraulic Crane - a Demag AC1600/ AC500 comes on 9/8 axles, whereas a similar capacity Chinese crane has 6 Axles. With a price difference of almost 50% between the two for a similar capacity crane it will be interesting to see who captures the market in the long run. Rishi Sunak would call this a case of Chinese Industrial Espionage, but only time will tell who wins the race!

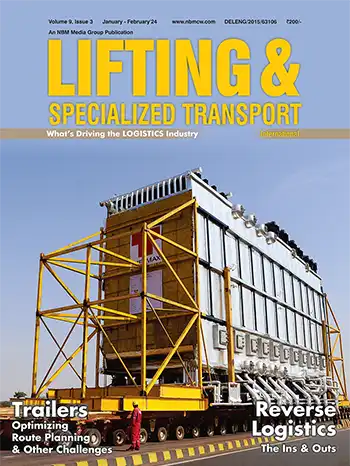

Please share a case study of ODC transportation/Launching done by Premier Infra recently.

A recent challenging project for which we also got recognized nationally, involved the transportation and launch of 200 U-Girders (of over 40,000 MT) within 25 days. This was a 1.6 km stretch for the Noida Metro Line connecting Pari Chowk in Greater Noida. The Limca Book of Records registered this job as the fastest launch of U Girders in the history of India.

Another challenging task which we completed recently was at the DFCC Maharashtra site. For the first time in India, Pile Cages of 2m diameter, 35m length, and an approx. weight of 35 tons had to be lifted and transported to the site, and then installed. We have done thousands of tandem lifting jobs but to plan the installation of these pieces was a challenging process because of the elasticity of the TMT bars. To keep them in place and upright was the most difficult part, but we successfully installed 190 of them.

Lifting & Specialzed Transport, August - September 2022