Operating Profit of Cement Companies to Grow by Rs. 100-150/MT in FY26: ICRA

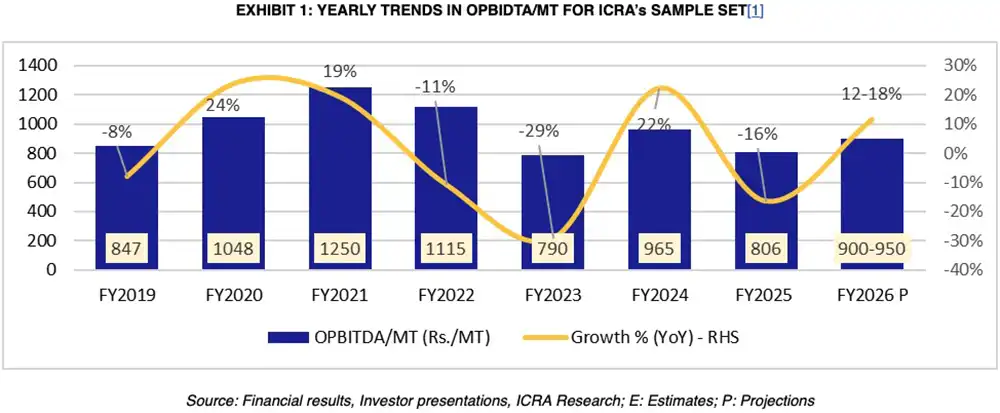

ICRA expects the GST cut to reduce overall construction expenses in rural housing by 0.8%-1.0%, boosting volumes and supported enhanced capacity addition. Backed by the healthy cement demand, average cement realisation (ex-factory price excluding GST) to rise by 3-5% in FY2026, even as the input prices are expected to remain range-bound, boosting the operating profit of cement companies by Rs. 100-150/MT. Further, OPBIDTA/MT is likely to improve by 12-18% to Rs. 900-950/MT in FY2026.

Cement volumes increased by 8.5% in 5M FY2026 due to strong demand from the housing and infrastructure segments, despite the early onset of the monsoons in a few regions. Cement prices have increased by ~7.4% in 5M FY2026 on a YoY basis, with major hikes in the northern and eastern regions. The trajectory of input prices, especially for pet coke and freight, are linked to global crude, which remains exposed to geopolitical dynamics.

Giving more insights, Anupama Reddy, Vice President and Co-Group Head, Corporate Ratings, ICRA, said, “With the recent GST rate cut from 28% to 18% expected to be passed on to customers, and the average retail price of cement currently ranging between Rs. 350 – 360 per bag, consumers are projected to benefit by Rs. 26–28 per bag. The GST cut makes rural housing more affordable and is likely to result in 0.8%-1.0% reduction in overall construction expenses in rural housing, which in turn would support demand. Driven by healthy demand, capacity additions may increase to 41-43 million MTPA in FY2026 from 31 million MTPA in FY2025, spearheaded by the eastern region, which is likely to lead the grinding capacity.”

With the estimated increase in cement realisation, along with likely stable cost structure, the OPBIDTA/MT for ICRA’s sample set is estimated to increase by 12-18% to Rs. 900-950/MT in FY2026. In FY2025, the OPBIDTA/MT had declined by 16% YoY due to weak realisations (especially during H1 FY2025, because of extended monsoon and impact on Government capex amid the General Elections). Overall, the credit profile of large cement producers is expected to remain stable, driven by a healthy growth in operating income, expected improvement in operating margins and comfortable leverage metrics. The industry has witnessed consolidation in recent years, and the performance of larger players is expected to outperform compared to that of mid-size players in the medium term.

“ICRA estimates green power to account for 43-45% of the total power mix by March 2026, compared to around 35% as of March 2023, for the cement companies in ICRA’s sample set. The major cement players in the country aim to reduce their emissions by 15-17% over the next 8-10 years by increasing the share of blended cement, which uses less clinker and consequently less fuel, boosting the share of green power consumption through a mix of solar, wind and waste heat recovery system (WHRS) capacities,” Reddy added.