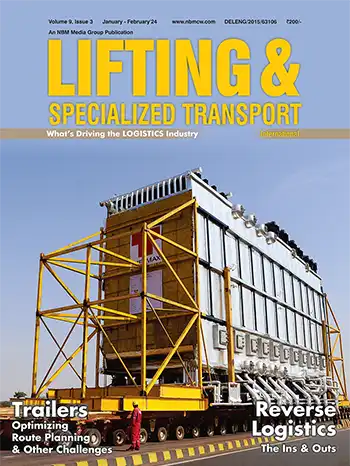

ACE – A Dominant Player in Crane Segment

Over the period, ACE has emerged as one of the most successful home grown companies in CE market with considerable presence in important infrastructure projects through its products and services. What creative business ethos has been enshrined in the company to turn its CE business vision into a reality as we see today?

Action Construction Equipment Limited (ACE) is India’s leading material handling and construction equipment manufacturing company with a majority market share in Mobile Cranes and Tower Cranes segment. In addition to Mobile Cranes, ACE also offers Mobile/Fixed Tower Cranes, Crawler Cranes, Truck Mounted Cranes, Lorry Loaders, Backhoe Loaders/Loaders, Vibratory Rollers, Forklifts, Tractors & Harvesters and other Construction Equipment. ACE has a consolidated presence in all major Infrastructure, Construction, Heavy Engineering, and Industrial Projects across the country.

ACE is a dominant player in the cranes market having introduced from time-to-time innovative crane solutions / products. Recently, it invented its New Generation Pick-n-carry cranes. What are its important technical attributes giving it an edge over others in this class?

ACE invented NEW GENERATION Pick-n-Carry cranes which have following features:

- These cranes use industrial driveline from Trucks resulting improved gear shifting, more operator comfort, and higher speeds.

- Cabin is in front and at lower height. Operator sits just like sitting in car. He has excellent all round visibility. Moreover, operator moves with Load providing safer operation.

- Overall machine height is much less as compared to present m/cs resulting lower CG and hence improved stability and very low chances of m/c toppling.

- Less number of structural parts known as Front and Rear Frame which are joined by pins having SELF aligning bearings providing flexibility in structure.

- Rear Frame is connected to axle through Leaf springs which acts as a suspension and provides jerk free ride.

- Luff cylinders are positioned in a way that the cylinders move away from load when the boom is lifted and hence more safe operation and it can lift steel plates and long pipes.

- Wheel Steering is standard just like cars and hence operator-friendly and easy movement of crane.

- Covered tool box is provided additional to open space for keeping goods.

The 12t and 16t cranes are more popular in Pre-cast segment. Most of the Developers have started building projects with precast segments because of higher speed of construction. Our tower cranes, which are known for their reliability and efficiency, are in good demand for such projects.

How does ACE look at the crane market evolving, competition getting stiff, pressure on pricing mounting, quality products taking off, demand and supply, sustainability maintaining etc, as the CE market breathe easy?

The policy of responding with speed and expertise has been rewarded over the years in the form of repeat business resulting in constant growth making us the leading company in the Mobile Cranes, Tower Cranes and Construction Equipment sector in the country. Another factor driving our growth has been the versatility of our equipment to satisfy a vast range of possible applications. Our equipment have been successfully used in many sectors like Infrastructure Construction, Power Projects, Ports & Shipyards, Dams, Metro Rail, Roads, Mining, Steel Industry, Engineering Industry, Railways, Cement, Petroleum, Defence, Chemicals & Fertilizer Plants, Warehousing, Logistics, Building Construction etc., to name a few.

What is the imported content of ACE products range? Will there be any impact on its import bill due to the fall in rupee value. How does ACE plan to slash its import bill so that shall not affect its business performance?

ACE has insignificant dependence on imports as it has its own state-of-art Research & Design facility which ensures best technology availability indigenously. However, there is some impact on imports bill due to increase of the dollar value, which ACE would be able to counter through quick indigenization.

A word about ACE dealership network, pre- and post market services and development of a sound vendor base.

ACE equipment are used throughout the country and to cater to this wide spread and to provide effective pre-sales and after sales service, the company has developed a network of Dealers and Area Offices operating out of 100 Locations and supported by 15 Area / Regional Offices based in Delhi, Mumbai, Chennai, Kolkata, Ahmedabad, Pune, Jaipur, Raipur, Bhubneshwar, Lucknow, Indore, Hyderabad, Bangalore, Vizag and Cochin. These area / regional offices are in turn supported by the Marketing HQ based in Delhi and a dedicated Product Support Division based in Faridabad.

We have also set up dealership in UAE, Qatar, Iran, Bangladesh, Egypt, and South Africa to provide support to our equipment working in Middle East Asia, South East Asia, and African countries.

What is ACE assessment as how the CE market in the country is expected to unfold as normalcy set in, may be in the first or the second quarter of the next year?

As per the study, new areas are emerging that hold good growth potential for the future, especially in rentals which currently contribute just about two per cent of a market which is expected to grow. Equipment leasing is another sector, and is expected to grow, then there is financing and end-to-end services where some of the large players are looking at providing end-to-end services to the users throughout the equipment lifecycle - financing, user training, maintenance and buy-back of used equipment.

Finally, there is export scenario where exports of CE from India should grow, and is expected to sustain this growth in future.

The key success factors for the future depends on innovative financing and value-added services where the focus is on increased penetration of financing leasing and rental services, providing adequate maintenance to equipment and training to crew, and facilitating immediate repair and refurbishing of equipment. The study also points out the importance of R&D and innovation in terms of appropriate product technology and pricing, product customization for different applications, product reliability and ease of use, and last but not the least, post sales support in terms of service and training infrastructure, focus on maintenance of equipment, ensuring the availability of spare parts and widening the distribution network to service the client better.

Despite the prevailing global uncertainties, rising needs of better infrastructure, modernized methods of agriculture and growing complexity of mining/manufacturing methods will boost demand for technologically advanced equipment in these industries. Moreover, looking ahead, the growth path widens for the emerging and developing nations, which will inevitably be attractive destinations for machine makers worldwide.

According to the World Economic Outlook Update published by the International Monetary Fund (IMF) in January 2013, the world economy is projected to grow 3.5% in 2013 (versus 3.6% projected in October 2012) and 4.1% in 2014. Growth in advanced economies and emerging and developing countries are projected at 1.4% (versus 1.5% expected earlier) and 5.5% (versus 5.6% expected earlier) in 2013, respectively. In 2014, advanced economies are projected to grow 2.2% and emerging markets 5.9%.

NBM&CW November 2013